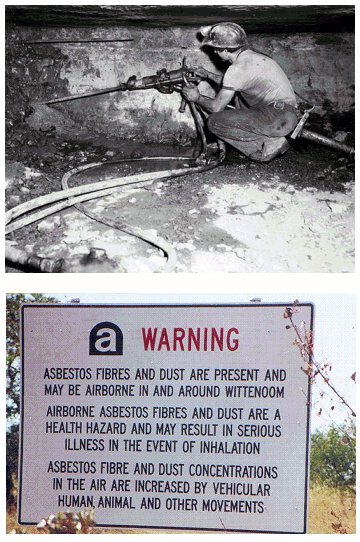

Right: TOP: Inside the Wittenoom blue asbestos mine: as well as the usual mine hazards miners were at great risk of mesothelioma in later life. BOTTOM: a warning sign outside Wittenoom today.

.

Right: TOP: Inside the Wittenoom blue asbestos mine: as well as the usual mine hazards miners were at great risk of mesothelioma in later life. BOTTOM: a warning sign outside Wittenoom today.

.Arguments suggesting the penalties were not adequate

1. The fines were not large enoughIt has been claimed that the fines imposed on the directors are inadequate given the number of asbestos victims who might need to be compensated and the extent of their suffering.

Corporate law expert and head of the School of Law at the University of Western Sydney, Michael Adams, said he was surprised by the low ranging fines and disqualifications as he considered 'the many victims of asbestos diseases from JHI products may not feel very much satisfaction from these penalties today.'

The widow of asbestos victim Bernie Banton said that she was disappointed with the fines handed down to disgraced former James Hardie executives in the New South Wales Supreme Court. Karen Banton stated, 'Bernie would've liked to have seen the penalties a lot higher. These people are going to have to give account, one day, when they finish this life, for their actions.'

Australian Manufacturing Workers Union secretary Paul Bastian said the fines and disqualifications would have little impact on the former board members of James Hardie. Mr Bastian stated, 'I don't think it will have much impact on any of them.'

On August 20, 2009, the Australian Council of Trade Unions issued a media release commenting on the penalties imposed on the James Hardie directors. The release stated, 'The penalties and bans handed down to former James Hardie executives and directors today are not enough considering the extent of their immoral and illegal behavior and the harm the company's deadly asbestos products have caused.'

Gippsland's Asbestos Related Diseases Support Network (GARDS) has also indicated it is disappointed by the penalties handed down to former James Hardie executives.

The secretary of GARDS, Vicky Hamilton, has stated that the punishments do not go far enough.

Ms Hamilton stated, 'If the laws were any different, I'd like to see them go to jail quite frankly.

They knew what they were doing, they did the wrong thing, they were taking money away from sufferers, it was disgusting to see that happening and they thought they were going to get away with it.'

It has also been claimed that the fines are too small to have any effect on directors and executives as well remunerated as these men and women. ABC reporter Mark Peacock has stated, 'If you looks at someone like Meredith Hellicar, got a payout of over a million dollars when she left the company - has now got a fine of $30,000. That's a drop in the ocean.'

It has further been noted that the fines imposed do not even approximate those recommended by the Australian Securities Investments Commission (ASIC). ASIC had asked the court to disqualify former chief executive Mr Macdonald for up to 16 years and fine him between $1.47 million to $1.81 million. While Mr Macdonald was banned for fifteen years, the fine imposed on him was only $350,000.

Professor Michael Adams is Head of the School of Law at University of Western Sydney, and for 25 years has conducted research into corporate law in Australia, Europe, North America and Asia. After following the James Hardie case closely over the years, Professor Adams stated that the $80,000 fine imposed on James Hardie Industries for breaching corporations' law is comparable to a parking fine in terms of the company's size and ability to profit.

2. Some of the directors may avoid the fines and bans imposed on them

Former James Hardie directors and executives may escape personally paying any fines imposed yesterday for breaching their duties.

It has been suggested that some of the fines may be covered by an offshore James Hardie company and the executives and directors could also have their legal fees paid for them

ABC reporter, Nonee Walsh, has made the same point. She has stated, 'The fines and legal costs imposed on the former chief executive, Peter Macdonald, and board directors are likely to be covered under indemnity agreements with James Hardie, and by directors insurance.'

It is also likely that James Hardie will appeal the findings. James Hardie has spent $25 million so far fighting ASIC's case.

It also appears that some of the directors will be able to avoid paying their own legal fees and those of ASIC.

The Australian Corporations Act prohibits companies indemnifying directors and executives if they lose this type of civil penalty case. ASIC said in evidence to a Senate committee in 2007: 'It may be open for a company to loan or advance money to the former officer for use in defending the proceedings with the stipulation that the money must be repaid in the event that the officer is unsuccessful in his or her defence.' However, given that the former James Hardie directors and executives have lost the civil case, they would need to repay James Hardie's the cost of their legal representation.

Despite this, not all the directors will have to pay their own legal costs. Some of the former directors and executives have indemnities from foreign companies in the James Hardie group, which might allow them to claim that the prohibition does not apply to them. In this case they will not have to reimburse James Hardies for the money spent on their legal fees.

It has also been noted that many of the directors may be able to continue to work on boards, despite the bans, as these bans only apply within Australia.

Professor Ian Ramsay from Melbourne University says four former directors, including former chief executive Peter MacDonald, are based in the United States, meaning there is nothing stopping them from working for companies, including James Hardie, which are registered in other countries.

3. James Hardie's former chairman, Alan McGregor, died before his conduct could be investigated

It has been suggested that James Hardie's former chairman, Alan McGregor, had a large part to pay in the company attempting to side-step its financial obligations to asbestos victims. It has further been suggested that Mr McGregor's estate should not simply be allowed to benefit from his remuneration from James Hardie.

On August 21, 2009, Stephen Mayne, writing for the online business journal, Crickey, claimed, 'Alan McGregor's name has barely been mentioned in the media since he died of cancer in February 2005 but there is something wrong with his family still swanning around with an estimated $50 million...

When McGregor died, his 8.6 million James Hardie shares were worth almost $60 million. As chairman of the company, he could have snuffed out the whole sordid exercise but instead he conducted a rather large orchestra of co-offenders and had a huge financial incentive to do so.'

Mr McGregor's departure, due to ill-health, coincided with the news that a special enforcement team at the Australian Securities and Investments Commission was to investigate the company over allegations aired at a New South Wales inquiry about the foundation James Hardie set up to pay asbestos claims.

Corporate lawyer for James Hardie, Peter Cameron, also died prior to the completion of the investigation into Hardie's compensation provisions for asbestos victims.

Particularly in the case of Alan McGregor, Stephen Mayne has suggested that the estates of those who have been found guilty of improper corporate conduct should be penalised.

4. The penalties will not act a sufficient disincentive to other directors

It has been suggested that penalties such as those imposed on the James Hardie directors are not sufficiently large to act as a disincentive to other company directors. According to this line of argument, many board directors receive such large salaries that there would have to be significant penalties imposed to prevent some of them boosting their salary and share packages by taking actions that are of doubtful propriety.

While still a part-time role, non-executive directors are receiving increasingly large compensation for their expertise and time. Elizabeth Nosworthy served as a director of Babcock & Brown, Venerator, Commander Communications and GPT. Despite BNB, Ventracor and Commander collapsing last year and GPT shares falling by more than 90%, Nosworthy collected more than $640,000 in directors' fees in 2007 - equivalent to more than 11 times the average Australian weekly wage.

Professor Michael Adams is Head of the School of Law at University of Western Sydney, and for 25 years has conducted research into corporate law in Australia, Europe, North America and Asia. After following the James Hardie case closely over the years, Professor Adams stated that unfortunately, penalties like the ones imposed on the James Hardie directors and executives do not act as a deterrent for poor corporate governance or corporate social responsibility practices.

5. Australian courts seem to treat those who commit corporate offences as less blameworthy

It has been suggested that Australian courts treat corporate misconduct as in some way less serious than other crimes.

This point has been made by Professor Mark Findlay, director of the Institute of Criminology at the University of Sydney, who has stated, 'Courts in Australia seem to deal with corporate crime in an unusually lenient fashion, relative to what courts do in other countries and certainly relative to the way in which we punish an individual for doing what the directors or the company have done in this case.'

Professor Findlay has gone on to claim, 'I think the issue is that we need to start thinking more creatively about the sorts of punishments we impose, because relatively small fines and bans from sitting on company boards for people who have lots of money doesn't really have an enormous impact. So I think we need to start thinking ... [about] punishments on companies that really hurt.'

There are those who have called for criminal sanctions for corporate negligence and other corporate actions placing workers and the community at risk.

Independent senator Nick Xenophon has claimed that the penalties handed out to James Hardie executives do not go far enough. Senator Xenophon has called for uniform industrial manslaughter laws to be introduced.

Senator Xenophon said there needed to be tougher sanctions and jail terms should be introduced for company directors who endanger the lives of employees.

Senator Xenophon stated, ''This corporate restructuring was about avoiding their financial liabilities in terms of an asbestos compensation fund.

It would not have come to this if we had industrial manslaughter rules in place where company directors would be jailed for peddling a dangerous product that could kill or maim people.'