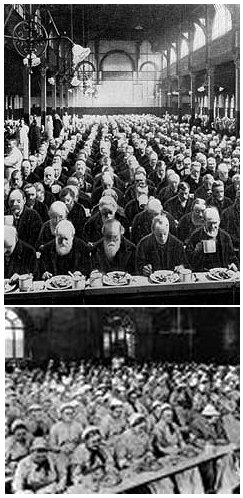

Right: Before introduction of the old age pension in England, destitute old people, along with other men, women and children without means of sustenance, could apply to be taken in to "workhouses". A workhouse supplied basic food and lodging, with inmates obliged to do various kinds of work if required.

Right: Before introduction of the old age pension in England, destitute old people, along with other men, women and children without means of sustenance, could apply to be taken in to "workhouses". A workhouse supplied basic food and lodging, with inmates obliged to do various kinds of work if required.

Arguments in favour of Australia's retirement age being lifted to 67

1. It will reduce the number of retirees dependent on a shrinking taxpayer baseThree factors are impacting on the proportion of Australians who are taxpayers relative to those who are drawing age pensions.

Declining birth rates have meant that the number of young Australians becoming taxpayers is declining relative to the total population. Increased longevity is having the same effect. Australia has the fifth highest life expectancy in the developed world. This means again that the proportion of the population drawing on age pensions is also growing relative to the tax paying population.

The third factor impacting on this is that the group of Australians born in the generation after World War II (commonly referred to as 'baby boomers') is approaching retirement age. This demographic bulge will also increase the ratio of pensioners to taxpayers.

In the lead-up to the federal budget of may 2009, the Business Council of Australia (BCA) released a paper outlining its concerns regarding Australia's growing, ageing population, warning that that the number of people aged 65 or older will increase from 2.9 million to an estimated 7.4 million by 2049.

The BCA argued that the growth in the proportion of older people had major implications for the aged pension and for Federal and State budgets if taxation revenues were to shrink. It said retirement ages would have to be lifted significantly in the decades to come to ensure the proportion of five people of working age for every one retired was maintained.

Leon Gettler, writing for The Age in a blog comment issued on March 31, 2010, has stated, '...the number of people aged 65 to 84 years will more than double over the next 40 years. Expect the number of people 85 years and over to more than quadruple. From an economic point of view, ensuring these people will stay in the workforce would solve some of these problems as these employees would save the public purse by not drawing pensions and they would continue to pay taxes.'

2. Most Australians will still be able to enjoy a substantial retirement period

When the aged pension was introduced in Australia in 1909 the average male life expectancy was 55 years. The retirement age was set at 65 years. This meant that very many Australian men did not live to retirement age and so did not draw an old age pension. It also meant that many men did not live for long after their retirement.

Until the 1970s, the amount of time that a person aged 65 years could expect to spend on the Age Pension remained fairly constant, at about 12 years.

Increased life expectancy means that even when the retirement age is increased to 67 most Australians will still have a substantial period in their later years during which they will not need to undertake paid employment in order to support themselves.

According to United Nations estimates, Australia has the joint fourth-highest life expectancy in the world (along with Switzerland) over the period 2005-10 when ranked by male life expectancy. Only Iceland, Japan and Hong Kong have higher male life expectancy than Australia. Australia also has the joint third-highest female life expectancy. Like in most countries, female life expectancy is higher than male life expectancy in Australia.

Average male life expectancy in Australia is 79 and average female life expectancy is 84. In terms of the period a person is likely to spend drawing an old age pension, these figures are somewhat misleading. Those who live to 65 have a higher life expectancy than the average because they have avoided all the causes of death which have led to the deaths of those who do not reach 65.

Therefore, even though the retirement age in Australia is to be increased to 67, increased life expectancy will mean that those who do not receive a pension until this later age will still enjoy a substantial period of pensionable retirement.

3. It will enable the skills of older Australians to continue to be drawn on in the workplace

It has been noted that older Australians have skills and experience that are of great value to employers.

Older workers often have what is referred to as 'corporate knowledge', that is, particular experience of how an individual workplace or corporation operates. It is argued that this is knowledge that a younger, inexperienced employee might takes years to acquire and its absence could result in a significant loss in either efficiency or production.

The Australian Human Rights Commission has stated, 'We are seeing a dramatic loss of corporate knowledge. This knowledge is the product of a long-term investment in training and experience and is difficult to replace. On top of this is the time consuming and expensive process of recruiting and training new staff.

Workforce productivity and growth are major factors in overall economic growth. If the growth of the workforce slows, then that will have dramatic consequences and implications for all Australian businesses, including the government and community sectors.'

It has also been claimed that older workers bring valuable life experience and judgement. It has further been suggested that as the population ages there will be many customers who will prefer to have services provided by people closer in age to themselves.

Banks such as Westpac and St George along with major retailers Coles and Woolworths are actively recruiting older workers through diversity programs and specialist recruiters.

Stuart Elliott, Westpac's head of people strategy and development, has claimed that among the particular strengths older workers often bring to the workplace include judgement and wisdom. "A lot of the time in banking, we're talking about issues of risk management or judgement, and we use the term "It would be good to get some grey hairs" working in this sort of space because they are the people who are actually able to understand the complexity and what's happened in the past. Despite our desire to think that things are actually incredibly different now to how they were 15 years ago, they're not."

John Piggott, a professor of economics at the Australian School of Business and director of the Australian Institute for Population Ageing Research, has stated, 'It may be that an increasing proportion of [the] customer base would prefer the [person] behind the counter to look [older] than 20. So I think there is a customer relationship motivation and there also is a kind of political correctness motivation.'

Mal Walker, the founder of the specialist mature-age executive placement firm, GreyHair Alchemy, has stated, 'People are talking about the serious experience drain that's about to hit us, so I'm getting a lot of traction wherever I go [to seek placements].'

4. Provisions can be made to make extended employment more attractive and flexible

There is a wide range of employment arrangements that can be made to allow workers to have a more pleasant and productive extended worklife.

It has been claimed that many companies are already rethinking the way in which they employ their older workers. Some encourage more part time work or have their older workers go casual and contract their work back in.

Some companies and organisations like Australia Post and National Australia Bank are redesigning work around older workers, many of whom tend to choose to stay on with more flexible work packages that might, for example, allow them to take sabbaticals, huge slabs of unpaid leave, or one day off a week as part of their long service leave.

One of Australia's biggest shift operators, Australia Post trains its managers to have conversations with older employees about personal issues and career aspirations. This allows Australia Post to be more informed about the desires of its older workers and to shape their working arrangements accordingly.

5. Such an increase is in line with trends all over the world

It has been noted that increasing the retirement age has become a trend all over the world as advanced economies respond to the demands of their ageing populations.

France has recently increased the retirement age from 60 to 62. In the United States, while the normal retirement age for Social Security, or Old Age Survivors Insurance (OASI), historically has been age 65 to receive unreduced benefits, it is gradually increasing to age 67. For those turning 65 in 2008, full benefits will be payable beginning at age 66.

Britain is increasing its pension age to 68 from its current level of 65 between 2024 and 2046. In Austria, the retirement age for women will be gradually raised from 60 to 65 between 2024 and 2033. In Belgium, from 2009, the NRA for women will be raised from 64 to 65. Retirement ages for men and women in the Czech Republic have been increasing by two months and four months every year respectively since 1996. By 2013, the aim is to reach the target retirement age of 63 for males and 59 - 63 for females, depending on the number of children raised. Denmark will increase the NRA age for men and women from 65 to 67 between 2024 and 2027. Germany, too, is increasing the age for men and women from 65 to 67 between 2012 and 2029.

In Hungary, the government plans to pass legislation to increase the retirement age from 61/62 to 64 for women and from 62 to 65 for men by 2020 and then to 68 for women and to 69 for men by 2050. Israeli legislation in 2004 is gradually raising (according to date of birth) the retirement age from 65 to 67 for males and from 60 to 64 for females. In Italy, the government is proposing to increase the minimum retirement age from 57 to 58 in 2008 and then to 61 by 2013.

Japan is gradually increasing the retirement age under Employees' Pension Insurance from 60 to 65. For company-sponsored retirement plans in Japan, the normal retirement age is gradually being extended from 60 to 65 between 2006 and 2013. The Singaporean government's long-term objective is to increase the retirement age from 62 to 67 for men and women but it has not yet implemented legislation. In South Korea, the normal retirement age will increase from 60 to 61 in 2013 and then further by one year every 5 years until NRA reaches a standard 65.

The chairman of the new Australian Institute for Population Ageing Research, Marc de Cure, has stated, 'Australia needs to increase its taxation base, change consumption habits, encourage people to work past the current retirement age and develop a more resource-efficient health system.'