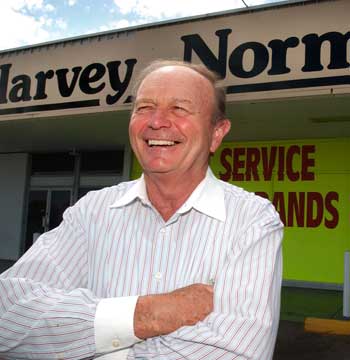

Right: Harvey Norman founder Gerry Harvey is an outspoken critic of what he sees as government inaction on things like GST on online purchases..

Right: Harvey Norman founder Gerry Harvey is an outspoken critic of what he sees as government inaction on things like GST on online purchases..

Found a word you're not familiar with? Double-click that word to bring up a dictionary reference to it. The dictionary page includes an audio sound file with which to actually hear the word said. Found a word you're not familiar with? Double-click that word to bring up a dictionary reference to it. The dictionary page includes an audio sound file with which to actually hear the word said. |

Arguments against taxing more on-line purchases

Arguments against taxing more on-line purchases

1. Australian retailers often charge more than their overseas competitors

It has been claimed that introducing a GST on more imported online goods will not stop Australian shoppers from continuing to buy online from overseas suppliers. The problem is that many Australian retailers simply charge more for the goods they sell and this encourages Australian consumers to look elsewhere.

An article published in Crikey in May, 2011, included the following comparisons between prices charged for goods in the United States and the prices charged Australian consumers.

A LG refrigerator costing $2500 at Harvey Norman is available to American consumers from Amazon for just under US$1500. A Sharp microwave costing $199 at Harvey Norman is at US$85 from Amazon and US$74 at Walmart. A $150 drill at Bunnings is available for under US$130 at Amazon. Pentax lenses costing nearly $850 in Australia are available for US$510 from a United States site. High-end audio equipment generally costs some three times as much in Australia as overseas.

In a study of more than 200 prices, the Australian consumer magazine Choice identified 'an approximate 50 per cent price difference between what Australians and US consumers pay for more or less identical products', such as music downloads, games, software and computer hardware.

It has been claimed that part of the reason for this is that many overseas suppliers charge Australian retailers higher prices. The Department of Broadband, Communications and the Digital Economy has noted that the primary cause of higher prices paid by Australians were 'decisions by international distributors'.

Choice has similarly stated that the most likely cause of higher prices was 'international price discrimination' whereby multinationals were 'setting the wholesale cost of their products higher for particular markets such as Australia'.

2. Collecting online taxes is difficult and uneconomic

It has been claimed that imposing a GST on imported goods purchased online would be very hard to implement and may well rise very little once the cost of administration was factored in.

The federal Assistant Treasurer David Bradbury has said the problem with lowering the GST threshold was the fact that the retailers involved were overseas.

Mr Bradbury has claimed, 'So even if we pass a law in which we say, "You have to register for GST", the difficulty we have is when they thumb their nose at us and say "Well, we're not going to. At that point we have an enforcement issue.'

In 2011, the Productivity Commission found that any extra revenue gains from lowering the GST threshold for overseas purchases would be outweighed by the cost of collecting it.

The Productivity Commission found that lowering the GST threshold to $20 on imported goods would raise in excess of $500 million in tax revenues, but the cost of parcel processing using the current system would jump by almost $1.6 billion - three times the additional revenue collected.

Professor Rick Krever, Director of the Taxation Law and Policy Research Institute at Monash University, has stated, 'I don't think it will ever happen just because the cost/benefit is ridiculous.'

Professor Krever said it was a 'fantasy' to suggest that overseas retailers would be willing to collect tax.

The professor stated, 'It would be interesting if Australia did something nobody else has been able to do.' He added that while Europe was one case where there was a GST rule for giant retailers such as Amazon and Microsoft, it only worked because there was an enforcement mechanism, with Microsoft having offices and employees based in Europe.

John Freebairn, economics professor at the University of Melbourne, said he would largely back the framework that the productivity commission used. Professor Freebairn stated, 'Until these scare mongers come up with a new low cost administrative system they're basically paddling up a dry creek going nowhere.'

3. Online shopping offers many attractions in addition to lower prices

A survey conducted in March this year by the Australia Institute found that consumers saved between 50 per cent and 75 per cent on many items by purchasing from online overseas stores; however, reduced costs are not the only attraction for those who shop online.

The same survey found that while 85 per cent of respondents shop online to save money, 54 per cent want to save time, around a third to avoid travel and shopping centres and 23 per cent to avoid salespeople. It has been claimed that apart from lower prices, other major attractions of online shopping - saving time and avoiding shopping centres - have to be recognised as meeting the needs of a significant population of consumers.

The Assistant Treasurer, Bill Shorten, has stated, 'Consumers enjoy shopping online because it offers them choice, convenience and often discounts far beyond 10%, because international retailers have embraced the digital economy and have developed sophisticated and consumer friendly business models.'

Adam Ferrier, a consumer psychologist from Naked Communications, has stated, 'The main motivation to purchase online can be ease of access, breadth of range and access to things that aren't available here.'

A review conducted by Price Waterhouse Coopers in 2012 suggested that there were a range of factors in addition to simple price which helped to explain the growing popularity of online shopping. These included greater variety and choice of goods; the rapidly increasingly usage of mobile devices; the continued strength of the Australian dollar; the use of social media by both consumers and retailers to drive brand awareness and the proliferation of group buying sites.

4. Australian retailers should also sell online

It has been argued that rather than trying to limit the impact of online purchasing, Australian retailers should sell some of their stock online.

In their recent report Economic Structure and Performance of the Australian Retail Industry, the Productivity Commission noted that 'Australia also appears to lag a number of comparable countries in its development of online retailing'. There are many who have argued that the salvation for bricks and mortar retail enterprises is to offer their customers a mixed service that includes the opportunity to buy online.

Launa Inman, the former Target chief executive, has argued that despite a tough year for retailers, online retailers had just enjoyed a 'phenomenal' Christmas. Ms Inman has stated, ''I think that every retailer really needs to expedite their online, because that will be the saving grace.'

KPMG's head of retail for the Asia-Pacific, George Svinos, has stated that the winners in retail would be those who were able to combine both online and offline sales.

Mr Svinos has said, 'There are amazing ways of using the internet to help the bricks-and-mortar retailers and we are yet to make those sorts of investments. There are great examples overseas of websites showing which store closest to me has the product I want. I can choose to go the store and pick it up. As a retailer, I get the benefit of the customer coming into my physical store because two out of three customers will make additional purchases.'

Jenny Nethercote, from The Hattery in Katoomba and hatsdirect.com, says their small business has been online for the past 10 years. Ms Nethercote has stated, 'We get customers who come into the store but haven't made up their mind and want to think about it. We'll give them a head size and once they've decided what they want, they order online...The big retailers ... can benefit by being online and having a shop. Small businesses are picking up on online because they know people haven't time to shop, and are more and more switched on to computers.'

5. The extent and effect of online shopping is exaggerated

It has been claimed that large Australian retailers exaggerate the extent and the effect of online shopping.

The Assistant Treasurer, Bill Shorten, has stated, 'Online retail sales account for about 3% of all retail sales in Australia, and it is estimated that between 20% to half of these sales relate to overseas purchases...'

Similar data has been generated within the United Kingdom where a 2004 study has suggested 'fears that the Internet will take over the [traditional] retail arena seem, at least at this point in time, overblown and exaggerated'. While British research from 2007 suggests that, 'although consumers often consult the Internet before going shopping, it is unlikely, at least in the short term, to have a significant effect on demand levels, in city centre stores'.

Opponents of lowering the tax threshold on goods sold in Australia through the Internet stress, as does Mr Shorten, that a large majority of online shoppers in Australia are buying goods from Australia retailers. The results of a survey titled The Changing Face of Retail conducted in June 2012 include the statistic, 'International sites are being used less often than Australian sites, with 7 per cent of consumers shopping online internationally weekly, compared with 12 per cent shopping weekly at local sites.'

Bill Shorten has further argued that the lack of a GST on online goods costing less than $1000 is unlikely to be a significant contributor to the reduced sales Australian retailers are currently enduring.

Mr Shorten has stated, 'There is no denying that retailers are doing it tough, but other factors like the high Aussie dollar, the ongoing aftershocks of the GFC and the fact that Australians are simply spending less ... are having a much greater impact than the absence of a 10% GST on a small number of overseas imports.'