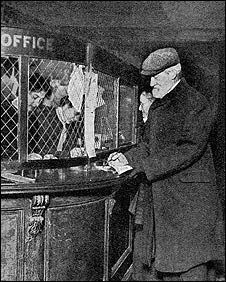

Right: Great Britain, or England, debated the subject of an aged pension for decades, before finally setting an amount of five shillings (fifty cents) a week and paying the first pensioners in 1909 - the same year as Australia did.

Right: Great Britain, or England, debated the subject of an aged pension for decades, before finally setting an amount of five shillings (fifty cents) a week and paying the first pensioners in 1909 - the same year as Australia did.

Found a word you're not familiar with? Double-click that word to bring up a dictionary reference to it. The dictionary page includes an audio sound file with which to actually hear the word said. Found a word you're not familiar with? Double-click that word to bring up a dictionary reference to it. The dictionary page includes an audio sound file with which to actually hear the word said. |

Background information

Background information

The age pension in Australia

(Much of the information reprinted below has been taken from the Australian Bureau of Statistics site. It was provided by the Department of Social Security.

The full text can be accessed at http://www.abs.gov.au/ausstats/abs@.nsf/94713ad445ff1425ca25682000192af2/8e72c4526a94aaedca2569de00296978!OpenDocument)

At the beginning of the 1900s there was no social security system in Australia. Charitable relief was provided to needy persons by voluntary organisations, in some cases with the assistance of government grants.

The main areas of need which attracted charitable assistance were the 'sick poor', neglected children, old people who were destitute and women who had been deserted or who had 'fallen' pregnant. The unemployed were assisted by grants of wages, or rations, in return for relief work provided by the government.

The Commonwealth of Australia was formed on the 1st of January 1901 by the federation of the six States under a written constitution which, among other things, authorised the new Commonwealth Parliament to legislate in respect of age and invalid pensions. The Commonwealth did not exercise this power until June 1908 when legislation providing for the introduction of means-tested 'flat-rate' age and invalid pensions was passed. The new pensions, which were financed from general revenue, came into operation in July 1909 and December 1910 respectively. These federal pensions replaced State age pension schemes which had been introduced in New South Wales (1900), Victoria (1900) and Queensland (1908) and an invalid pension scheme introduced in New South Wales (1908).

The new pension was paid to men from age 65. It was paid to women at age 60, but not until December 1910. (The pension age for women was later increased to 65 for women as well as men.) The age pension was also subject to a residence qualification of 25 years which was reduced to 20 years shortly after introduction. A residence qualification of five years applied to the invalid pension.

A major change took place in the pension means test in 1961. The separate property and income tests, which previously had formed the means test, were combined into a composite whole called the merged means test under which means were calculated by adding personal earnings to 10 per cent of the value of property. In 1962 there was a reduction from 20 to 10 years in the residence qualification for age pension.

A standard rate of pension was introduced in 1963. Before that, the maximum rate of pension for a single person was the same as for a married person. The new standard rate gave single pensioners a higher payment in recognition of the economies available to a married couple from sharing living expenses.

In May 2009, Labor Treasurer, Wayne Swan, announced that the pension age would be incrementally increased from 65 to 67. It was announced that everyone born after 1 January 1957 would have an age pension age of 67. The increased longevity of Australians was the reason given for this increase in pension age.