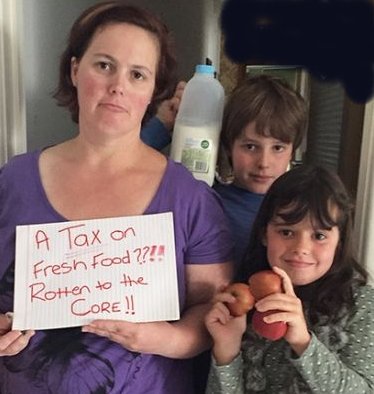

Right: grass-roots politics; this image was used by an organisation campaigning against a GST on fresh food.

Right: grass-roots politics; this image was used by an organisation campaigning against a GST on fresh food.

Found a word you're not familiar with? Double-click that word to bring up a dictionary reference to it. The dictionary page includes an audio sound file with which to actually hear the word said. Found a word you're not familiar with? Double-click that word to bring up a dictionary reference to it. The dictionary page includes an audio sound file with which to actually hear the word said. |

Background information

Background information

(The information below is an abridged version of that found in the Wikipedia entry titled 'Goods and Services Tax (Australia)'

The full entry can be found at http://en.wikipedia.org/wiki/Goods_and_Services_Tax_%28Australia%29)

The Goods and Services Tax (GST) in Australia is a value added tax of 10% on most goods and services sales. It is an indirect, or consumption tax, levied on what is consumed or purchased, rather than a direct tax, such as income or company tax, which is levied on monies earned. The GST is levied on most transactions in the production process, but is refunded to all parties in the chain of production other than the final consumer.

GST revenue distributed to the States

The GST revenue is then redistributed to the states and territories via the Commonwealth Grants Commission process. Whilst the rate is currently set at 10%, there are many domestically consumed items that are effectively zero-rated (GST-free). Food, health and education services, water and sewage are exempted, and so are financial services, as well as exemptions for Government charges and fees that are themselves in the nature of taxes.

Introduction of the GST

The tax was introduced by the Howard Government and commenced on 1 July 2000, replacing the previous federal wholesale sales tax system and designed to phase out a number of various State and Territory Government taxes, duties and levies such as banking taxes and stamp duty.

Economic and social effects

Critics have argued that the GST is a regressive tax, which has a more pronounced effect on lower income earners, meaning that the tax consumes a higher proportion of their income, compared to those earning large incomes. However, due to the corresponding reductions in personal income taxes, state banking taxes, federal wholesale taxes and some fuel taxes that were implemented when the GST was introduced, former Treasurer Peter Costello claimed that people were effectively paying no extra tax.

The preceding months before the GST became active saw a spike in consumption as consumers rushed to purchase goods that they perceived would be substantially more expensive with the GST. Once the tax came into effect, consumer consumption and economic growth declined such that by the first fiscal quarter of 2001, the Australian economy recorded negative economic growth for the first time in more than 10 years. Consumption soon returned to normal however. The Government was criticised by small business owners over the increased administrative responsibilities of submitting Business Activity Statements (BAS) on a quarterly basis to the Australian Taxation Office.

A study commissioned by the Curtin University of Technology, Perth in 2000 argued that the introduction of the GST would negatively impact the real estate market as it would add up to 8 percent to the cost of new homes and reduce demand by about 12 percent. The real estate market returned to boom between 2002 and 2004 where property prices and demand increased dramatically, particularly in Sydney and Melbourne. During the 2004-2006 period Perth also witnessed a sharp climb in real estate prices and demand.